Q and A

KEFI Minerals is committed to providing full and transparent disclosure of its activities, primarily via releases to AIM's company announcement platform. KEFI also holds a live webinar shortly after the release of the Company's Quarterly Operations Report during which shareholders's questions are answered (and recordings are available on KEFI's website).

KEFI often receives follow-up questions as well as questions regarding how market developments may impact the Company. Under AIM rules, KEFI Minerals cannot be party to selective disclosure of information to individual investors. Whilst some conversations are about material already in the public domain, it is a Company policy to be cautious about one-to-one conversation with individual shareholders.

In order to make answers to these questions broadly available, KEFI has set up this Q&A page to post answers to questions which are deemed likely to be of general interest. If you choose to post these answers on a bulletin board, we ask you to publish the Q&A verbatim on the bulletin board and cite this page as the source.

Please email your questions to info@kefi-goldandcopper.com.

Please comment and provide breakdown of the pay rate and industry standards, not because I agree with him but I believe more transparency would perhaps help inform those who may otherwise be confused, such as new shareholders, especially institutional investors.

A: We do not comment on commentators. And we provide a generic response to your question without having seen the publicity you refer to. The pay rates of all personnel are set by reference to industry surveys tabled to KEFI's Remuneration Committee of Non-Executive Directors, with advice from independent experts. We provide the link below to the only published industry remuneration report we found on a public website is: https://home.bedfordgroup.com/mining_compensation_report-2023

As regards KEFI’s senior executive remuneration, we have transparently provided statistics previously and also specifically in respect of the founder and Executive Chairman via the statutory accounts and via this Q&A section of KEFI's website.

For ease of reference, the tenure and remuneration for the Executive Chairman is as follows: Mr Anagnostaras-Adams founded the company and has been its Chairman since 2006 (except for a couple of years). He took on executive duties and started being remunerated from 2013-14 as Chairman and Chief Executive since 2014. His average level of base remuneration for the dual role of Chairman and CEO is below the average for this role as set out in independent industry surveys of comparable companies/roles. Over the past 12 years he has was paid an average of £190,000 per annum in cash and £87,000 in shares. His STI and LTI arrangements are also set out in the financial reports and are well inside industry ranges.

Q: Does the Tulu Kapi finance plan include all the capital required to fund all capex, all fees and financing charges, all requirements to set aside contingency provisions and cash reserves and anything else payable?

A: Yes.

Q: Do the offshore banking arrangements provide full transparency of disclosures to the Ethiopian regulators including central bank?

A: Of course. How else would KEFI and all other project parties including Government agencies as contractor and shareholder plus multi-lateral development banks with Ethiopia as member country conceivably wish to operate! The question itself is strange to put it mildly.

Q: Do KEFI and the operating company TKGM get credit in Ethiopia for all past spending?

A: Yes, in all respects.

Q: Is the company aware of the “minimum market cap” thresholds of large investment institutions? And can you inform shareholders?

A: We do not know all institutions and all their rules. As a general guide, we believe that Tier 1 institutions would rarely consider investing in a company with sub-$100 million market cap and most would like companies to also plan for a main board listing. KEFI has above-average liquidity and above-average upside-leverage. So we think we are reasonably well positioned in respect of this matter as we now advance through our business milestones.

A: We are getting requests to break out all sorts of costs like insurance, financing, compensation to households and other matters.

We already provide pre-closing guidance of the net cash flow for shareholders and NPV at various gold prices. This is intended to cover all projected costs.

Post-closing we will also break out whatever confirmed detail is normally properly disclosed without breaching privacy or other rules.

Q. It was previously indicated that triggering the plant repricing in July would allow the plant capex budget to last just 30 days before expiring the fixed pricing of the plant procurement. Does this mean we missed the boat and had to restart and, if so, what did that cost us?

A: The refreshing of plant pricing was formally triggered following Parliamentary Ratification of AFC in May, is being finalised now and the planned closing timetable accommodates the procurement schedules.

Q: What happened to the contractor funding as part of equity?

A: It is a sub-set of the $10 million of equity reported in the RNS to be issued at post-closing prices, for fees and costs. This is an improvement on what we foreshadowed some months ago. We can only set out final details at closing.

Q: Has the company had difficulty arranging comprehensive insurance coverage including political risks? And what is the cost?

A: All insurances arranged, via Marsh McLennan - perhaps the world’s largest insurance adviser/ broker. All of these and other normal opex costs included within ASIC estimates as published.

Q: May UK retail investors invest in the Ethiopian subsidiaries?

A: That is not possible because KEFI’s Ethiopian subsidiaries are unlisted companies in which only qualified investors (as defined in Ethiopian corporate law and regulation) may participate via a Private Placing with large investment sums and, despite being minority shareholders, any participant must sign the respective shareholders agreements and pledge their shares to the secured project lenders.

Q: I am trying to understand why KEFI is targeted for criticism on the anonymous chat lines.

Has the company created enemies in its business dealings? Or would it likely be disappointed shareholders?

Your guess would be better than mine. any comments the company is able to make?

A: The sector was probably the worst stockmarket performer in the past 10-15 years.

Whilst KEFI was one of the minority on AIM that survived, and whilst it has been built to to a position that should generate excellent returns, undoubtedly any shareholder is justifiably disappointed by the share price historically. We suffered too many unforeseen setbacks and too much share dilution to suggest that anyone should not have been very disappointed.

That includes company leadership that was paid average industry salaries for what was riskier than average work, and in shares.

But management has not and will not complain. Board and management take it on the chin and all are very excited.

It is also true that we have created some enemies in business dealings, but never by doing anything other than using the force of law to protect KEFI. Most of these situations are confidential whilst a few surfaced in litigation which KEFI has always won.

Q: Some shareholders feel that Richard Robinson has been on the Board too long as an independent and that Alistair Clark is too close to the Chairman to be independent.

A: Richard himself requested some time ago that we expedite his replacement as he believes it is time for him to be replaced. The Board agrees with his assessment and candidates are being considered. However, we await the finalisation of various negotiations and consultations with the various stakeholders with whom we are presently finalising the Tulu Kapi financing. In regards to Alistair, his oversight on ESG is critical at this particular stage in Ethiopia , not just in management's opinion.

Discussion about the board composition is healthy - we appreciate feedback and reach out to consult people from various constituencies. Both Richard and Alistair are of the highest integrity and are certainly independent minded. They have known the executives for 5 or 6 years and neither could be described as a personal friend of any executive.

Q: Thank you for the detailed Q and A which is unusually transparent for a listed company. But how can future timetables be more reliable than in the past?

A: Upon signing the Tulu Kapi funding package, the syndicate of parties will have aligned on timetable and key milestones. Then KEFI will be solely responsible to manage to the agreed schedule rather than KEFI continuing to strive to assemble commitments from as yet uncommitted parties.

And this will have been made possible by a calmed-down working environment in Ethiopia.

Leadership style and management composition will then also need to adjust accordingly.Frankly, it will be a refreshing relief to the team to have formal contractual commitments from all parties to the agreed schedule as set out in an agreed project execution plan. and to wrap the process in the enlarged planned team will finally be both warranted and necessary.

Lastly , the plan this year has been to have documentation ready by end June for launch to trigger upon certifications being completed as soon as possible from that date. That is what is happening and we will obviously announce when that occurs.

- cash is raised at price x to repay liabilities; or

- shares are issued at the same price x to repay the liabilities.

- Mining package

- Construction package (covering on-site work, roads, and power)

- TKGM shareholders package

- Secured loan facilities package

- £300,000 annual entitlement to cash remuneration, of which £150,000 had been paid at y/e 24 and £150,000 deferred which has not yet been paid.

- Retention bonuses of £185,000 taken in locked-in shares and £238,000 deferred cash which is scheduled to be paid from the proceeds of Tulu Kapi project financing. These decisions were not his and focused on overall fairness. The arithmetic could have been done in several different ways.

- £10,000 cost of medical insurance.

- Proportion of the aggregate charged to operating joint ventures for 2024 was 75%.

- Mr Anagnostaras-Adams has been Chairman since 2006 (except for a couple of years) and also Chief Executive since 2014

- He has received total cash remuneration of average £190.000 p.a. over 12 years or £120,000 p.a. averaged over 19 years i.e. neither he nor KEFI’s then mother-company Atalaya received remuneration in the initial 7 years.

- These numbers assume that his remuneration is actually brought up to date at the finance closing of Tulu Kapi, as he is owed over 12 months backpay. He has asked to be paid last.

- He has received total shares (instead of cash) remuneration of average £87,000 p.a. averaged over 12 years or £58,000 p.a. averaged over 19 years because nil consideration was received in the first 7 years. The shares also helped align him with the outcomes experienced by shareholders. He has sold no shares

- Mr. Anagnostaras-Adams’ base level of remuneration of £300,000 p.a. for the dual role of Chairman and CEO was set by reference to the then average for CEO’s as set out in independent industry surveys of comparable companies/roles .

- The base level STI and LTI schemes are set out in the Annual Report in detail. The LTI scheme is refreshed annually by shareholders as regards the authority to issue Incentive Options.

- It is important to note that no Incentive Options are in issue to any executives, including Mr Anagnostaras-Adams, under the LTI scheme as it was felt appropriate to only issue Options after full funding of Tulu Kapi is closed and reported

- Most other mining companies then operating in Ethiopia declared force majeure and/or lost their licences. Mr Anagnostaras-Adams has taken no significant absence from the Company for very many years and the KEFI Remuneration Committee does not consider his compensation to be excessive in these most difficult period.

- It is the Board’s view that Mr Anagnostaras-Adams’ leadership and dedication, supported by the team on the ground with him throughout many threatening years, saved the Company - and we are now looking forward to launching a major project against a background of record gold prices. A very significant achievement.

- The aim of the company and Mr Anagnostaras is to wipe the slate clean after a very challenging and unrewarding chapter for KEFI, and to focus on the significant value-adding opportunities ahead for the long-term benefit of shareholders.

The main questions received recently are summarised below as often we have received several similar questions.

Q: Why have KEFI shares performed so poorly, and only just beginning to show any promise?

A: As objective as the company can be in answering the question:

- The mining sector generally has been out of favour for many years. KEFI hopes this is now changing given high gold prices. KEFI is among the small number of AIM junior miners that have endured over the past 15 years since the last gold boom (which peaked at a gold price of c. $1,900/oz). Since then, the majority AIM-listed mining and exploration companies have ceased to be listed. KEFI remains.

- Despite significant challenges in both jurisdictions, KEFI chose to continue advancing its projects. This included the necessity of negotiating significant regulatory reforms in both host countries. In Ethiopia, we had to safeguard the project from upheavals at all levels as the country introduced democratic reform, and unfortunately endured a civil war. In Saudi Arabia, permitting was effectively frozen for approximately 8 years. Conditions precedent for financing and launching had to be modified with changed circumstances in order to achieve “bankability”. Much of this was not foreseeable.

- As a result, a significant amount of time and resources were diverted to defensive and corrective measures rather than directly advancing project work. To sustain these efforts KEFI raised equity capital on multiple occasions. This was deemed to be unavoidable and a necessary action for survival under adverse conditions beyond KEFI's control. The alternative would have been to relinquish the projects; KEFI has not contemplated this. We have built a strong growth platform which provides potential value growth as the sector, our countries and our projects get moving.

- With the (then dilutive) raised funds, KEFI discovered or acquired gold-equivalent resources amounting to c. 5 million ounces, of which its beneficial interest is c.2 million ounces. All orebodies are yet to be closed off and a large pipeline of other opportunities is in place.

- Currently, the net present value (NPV) of the Tulu Kapi Gold Project attributable to KEFI, and based on US$3,000/oz gold is c. $900M or c. £700M. This does not include any valuation for KEFI’s 15% stake in Gold and Minerals Co. This indicates considerable potential valuation upside from the company’s current market capitalization of £53M (post the May 2025 capital raise) as KEFI continues to de-risk the Tulu Kapi Gold Project.

- There is further potential valuation upside from the Saudi assets. In November 2024, Orior Capital valued KEFI’s 15% stake in Gold and Minerals at US$50m to US$78m based on a comparison with recent M&A transactions in Africa. The report is available on KEFI’s website.

Q: When you quote valuations per share, why do you not build in further dilution for future share issues?

- KEFI publishes valuation-style information using industry conventional metrics based on actual share capital.

- Making assumptions about future share offerings would constitute Forward Looking Statements. This could be interpreted as policy, and could potentially be materially misleading. The Company on the other hand publishes its policy – which is to minimise dilution by optimising the structuring of equity-risk capital at the different levels of the corporate structure.

- KEFI also sponsors proper in-depth research, given the lack of such research from the broking community, which generally does not allocate the time or resources to that function unless they can justify it with commissions made on share issues. Such research usually builds in assumptions about future changes to capital structure.

- Recent in-depth research on KEFI is by Orior and Edison, both uploaded onto KEFI’s website.

Q: Why did you not sell 15% of GMCO instead of raising money?

- KEFI announced a strategic review of its 15% stake in Gold and Minerals Co on 13 November 2024. This was not intended to be a ‘fire sale’, but rather a thorough review of KEFI’s choices and the cost/benefit of sale vs the other alternatives being worked on.

- In that context, there have been several significant developments in respect of Ethiopia, as follows:

- BCM, a leading mining contractor, being announced as the Preferred Contractor for the Tulu Kapi project in April 2025. BCM has agreed to contribute capital to the project, thus reducing the amount of capital that has to be raised from other sources.

- Interest in the Ethiopian Preference Shares (one of the very few dollar-denominated instruments available in Ethiopia), and interest in KEFI’s critical minerals licences.

- Major institutions joining the KEFI register to strengthen the group’s parent.

- But there have also been several significant developments in respect of Saudi Arabia, as follows:

- Gold and Minerals being awarded the Umm Hijlan licence at Hawiah in January 2025. Your Board believes this additional licence area adds significant further upside potential to the Hawiah project, both in terms of the VMS structures, and with the substantial outcropping and mineralised Mamilah gold system. Selling the stake in Gold and Minerals quickly would have deprived investors of the potential upside from exploration and development of this highly-prospective and known mineralised area.

- The joint venture between Gold and Minerals and Hancock Prospecting being awarded the Al Hajar Northern exploration licence area in March 2025. Al Hajar lies on the Wadi Shwas Mineral Belt, a trend that is approximately 50km east of the Wadi Bidah Mineral Belt that hosts Hawiah. Al Hajar hosts known mineralisation, and historical work supports walk-up drill targets. There is the potential ultimately for Hawiah and any discoveries at Al Hajar to be developed jointly, with substantial potential synergies and cost savings. Again, a quick sale of KEFI’s 15% stake would have deprived investors of this further development potential.

- The placing timing was driven by year-end audit sign-offs on solvency at KEFI, combined with pressure from KEFI’s bankers, contractors and the Government to commit certain costs (much of which can be recouped in due course) before drawdown of project finance for Tulu Kapi.

Q: How is the relationship with the majority Saudi partner, in light of the strategic review so far?

- The relationship with our JV partner is excellent.

- GMCO is now looking at the development of Stage 1 at the Jibal Qutman Gold Project in the short term, to be followed by that of the Hawiah Copper and Gold Project. GMCO will also keep under review the possibility and optimal timing of a GMCO IPO. These are not imminent actions, but longer term possibilities.

- ARTAR’s is a conglomerate which has until this past month been completely private. And it is therefore interesting that its first IPO was implemented only this past week - for ARTAR’s medical group SMC, which has publicly reported that it raised $500M for c. 30% of that subsidiary and that the IPO was oversubscribed many times.

- It is notable Saudi stock market places an attractive valuation on the only listed private sector-controlled miner, AMAK, which implies a very high potential valuation for the comparatively larger GMCO when it is production.

Q: Why does KEFI need institutional shareholders?

- KEFI is proud of its large retail shareholder following, with share turnover of over 100% pa being a healthy thing for any listed company.

- However, the transition of KEFI from explorer to producer requires structural change at many levels, including to introduce institutional long-term shareholders, which will also add stability and support to the underlying share price. The sale of the GMCO shareholding, even if it had already been possible, would not have addressed this matter.

Q: Why did you need to raise money if capex was already covered “there or thereabouts” with funds already arranged or falling into place?

A: We tried hard to ensure the capital raise of Q4 2024 brought us to financial close, however the delay to achieving Ethiopian Parliamentary Ratification of our bank’s country membership reaching this point plus some costs being brought forward, meant we were required to raise funds. The rationale of the raise was therefore:

- protecting solvency; and

- respecting the requests by the lender syndicate which, after all, is putting up almost all capex funding.

The bottom line is that the Project needed the money and KEFI had to put it up. We were fortunate that we were able to raise a large portion of the funds with specialist gold and other institutional investors, which concurrently addressed another important structural issue. Despite the additional shares in issue, the potential underlying value of KEFI continued to grow at the same time as the shares on issue and therefore remains many multiples of the prevailing share price; having taken so long to get the Tulu Kapi Project to a position of financial close on the broader $320M syndicate, we had to protect the Company’s position and did not want to delay or put the closing at risk.

Q: What was the basis for pricing the placing?

A: The KEFI share price has been at or below the placing price for practically the whole of 2025. Indeed on 1 May it was still below 0.55p. The uptick in share price stemmed primarily from a tweet from the Ethiopian Government (not KEFI) that it was set to finally award AFC its long-awaited country membership, which it subsequently delivered upon. Whilst this led to an improved share price it was also a contributing factor requiring KEFI to undertake a placing for reasons previously outlined. Given the historic share price during 2025, the placing price reflects very favourably to 20-day VWAP and beyond, whilst also being at the same level as the Q4 2024 raise.

Q: How do you explain the share turnover of +500M shares on the day the placing was announced?

A: 420M was the booking of one of the specialist gold funds that subscribed in the placing for £2,310,000. As announced, the shares from the Placing are to be admitted on 28 May 2025, at which point they would become a circa 4.5% owner in the Company. As a discretionary investment manager, a TR1 is not required to be filed by the specialist gold fund until its shareholding increases above 5%.

Q: Who are the institutional shareholders?

A: We now have quite a few institutional shareholders , mostly on-boarded over the past 9 months. It should be noted that no shareholder needs to publicly identify itself until it owns 3%. The institutions who permitted us to disclose their involvement herein are Ruffer Gold Fund, RAB Capital, Konwave Gold Equity Fund and Premier Miton. Time did not permit more of the other institutions to respond in time for this publication.

Q: Explain again the make-up of the funding package and the role played by the funds from the recent placing:

- The standing budget is $320M (currently undergoing final refreshing ahead of close) after deducting the mining fleet to be funded by the mining contractor and recouped from opex charges.

- Assuming the capex budget remains $320M, the funding sources are targeted as follows:

- $240M Secured lenders (committed by specialist African banks TDB and AFC)

- $80M equity-risk capital:

- $20M government, committed

- $23M mining contractor, committed in-principle

- $22M non-convertible Preference Shares issued by KEFI Minerals Ethiopia, commitments in-principle

- $15M already spent or already catered for in recent placing

- The above-listed aggregate is $80M, with some further flexibility within some of the components

- A small percentage movement (up or down) on the budgeted capex number can impact the final requirement. That is normal project management and is why we currently retain some flexibility within the syndicate allocations.

- We will also need to ensure that the disbursement schedule matches the FX drawdown schedule, either by domestic FX conversions or synchronising the currency of the drawdown.

- These matters are as finalised as they can presently be, pending the completion of the current exercises of confirming final budget on the eve of signing definitive documentation. Much of these exercises could only be triggered upon receipt of Parliamentary Ratification. To have jumped the gun would have risked having to duplicate the finalisation of certain costs.

- The total contracting package for capex and opex at Tulu Kapi represents aggregate financial commitments of almost $1 billion. Various teams on the ground and in the relevant international locations are well aware of the need to manage the process tightly and quickly. KEFI is responsible to lead, coordinate and support the overall process. In doing so, it has a fiduciary duty to its shareholders and also to its partners and its other financiers to strike an appropriate overall balance.

- There has to be “give and take” between the different stakeholders which is sometimes challenging but normal for such a large project.

Q: Please elaborate on the possibility of $5M costs being paid by KEFI shares, which has been referred to in recent investor presentations. Does that include any amounts payable to PDMR’s? Do any individuals have conflicts of interest?

- There are potential success fees payable to non-PDMR’s which exceed $5M.

- A smaller amount of potential bonuses also exist to PDMR’s (these have already been disclosed in past announcements and the Annual Report).

- It is reasonable to assume that an aggregate of a total of $5M of these fees will be accepted in shares if that is what KEFI wants/offers.

- The pricing of any of these shares would be at prevailing market prices post financial close (expected by the Company to be materially higher than current levels).

- They can also be paid in cash (assuming KEFI has the cash resources).

- This is a small fraction of the total project finance budget and provides flexibility in planning.

- The Company deals with conflicts of interest daily. It is part of fiduciary management to identify such issues and behave compliantly and honourably in all respects. KEFI’s assembly and preservation of alliances with Governments and major in-country and international organisations at all levels of the organisation should give some comfort to those stakeholders who are unfamiliar.

Q: How will we fund the KEFI corporate costs during construction at Tulu Kapi?

- Until any explorer has started production, all funding must naturally come from equity or debt. Plus in our situation, some past KEFI costs may be refunded in cash rather than converted into equity in projects

- Future corporate costs will remain under £1M per annum, bearing in mind the low-cost base in Cyprus and also after recoveries of costs from operating subsidiaries. KEFI has a contractual obligation to its financiers and contractors to build, oversee and support the fledgling project organisations, and we charge full refund of associated costs accordingly.

Q: How are salaries set - they seem so much higher than average income in the UK. Please specifically refer specific details with respect to the Executive Chairman, Finance Director and Chief Operating Officer.

- KEFI pays industry standard salary based on independent mining industry surveys, which has nothing to do with UK average incomes. And it is absolutely critical to recruit internationally experienced expert management for the first production project, let alone seriously pursue the company’s ambitious growth plans

- The remuneration of the top 3 executives is detailed in the Annual Report. Others in the group have been paid more than them but, to demonstrate commitment to the team, all three have typically historically taken their salaries twelve months in arrears and a large portion in shares, to support KEFI and align with shareholders. PDMR’s would make a formal disclosure if these shares are ever sold.

- Role definitions, performance reviews and remuneration decisions of these three and of all other personnel, are carried out by the Remuneration Committee and its sub-committees which take independent advice. We have a formal industry standard system, tying incentives to the specific KPI’s for which the executive is responsible.

Q: What is the history of the Executive Chairman at Atalaya Mining in Spain, KEFI and Venus Copper in Cyprus?

- He personally founded the three companies in 2005, focusing the combined missions of the three fledgling organisations on the Tethyan Belt from Spain to Cyprus, into Turkey and down into the Arabian Nubian Shield

- He stood down at Atalaya in 2013 to facilitate Spanish management once that company and its project was set up. It had hitherto been a mess but was then ready for localisation, which is critically important in southern Spain. He had no further involvement other than to support Atalaya and the Spanish authorities in prosecuting certain interfering third parties.

- He then switched his executive time to KEFI, which needed to achieve permitting, financing as well as to develop and not just remain focused on exploration. This was at the invitation of the major shareholders of the company which then owned Tulu Kapi Gold Project, which KEFI then proceeded to takeover and put in the right direction for development.

- Atalaya later transferred Venus Minerals back to the Chairman as Atalaya was uncommitted to Cyprus. The Chairman installed a team and JV partner to manage that whilst he has focused intensely on KEFI.

Q: When is the Annual Report being issued and when and where is the AGM being held?

- In early June we will issue the Annual Report, to be followed by a webinar with Q&A say a week later, to be followed by an AGM in London, which will have to be in July. We adjusted our plans last week in response to shareholder requests.

- We have had most AGM’s in London, but we have held it in Cyprus and Addis Ababa the last two meetings given attendance/cost. In response to recent requests by UK shareholders we are now arranging to return it to London this year and we will refine as shareholders wish.

Q: There was publicity about an EGM being proposed. Is this correct?

A: No formal request has been received. But we will be pleased to steer enquiries as appropriate.

Q. Is KEFI concerned that they have misled the market and their shareholders in that the timelines and information which has been released over the past 6 months was known to be false and / or unachievable?

A. Our announcements always provide achievable timelines that are always based on having checked with the counterparties involved ie they are reliable estimates at the time of publication if everyone delivers on schedule. However, the nature of such forecasts is that we can’t factor in potential delays from factors outside of our control. The main culprit recently was the delay in Ethiopian Parliamentary ratification of AFC Country Membership.

Q: Why be some open with communications if predictions of other people’s actions are often proven wrong?

A: That fundamental challenge will diminish as Tulu Kapi is launched and its progress much more predictable, with the funding under KEFI’s control rather than the control of other parties.

Q. Can the company please detail what they have spent over £1million per month on since the December raise?

A. The previous raise was mostly to repay liabilities as reported at the time.

Q. How can KEFI justify allowing Edison to release information on 20th March 2025 stating "No More Equity at Parent Company Level" and that short term funding is available at this stage of financial sign off if this is false?

A. Key events that have happened since publication of the Edison report are the delayed timing of Parliamentary Ratification and the fresh demands of the banks for closing and commitment fees.

Q. Why do we never hear from Eddy Solbrandt? Is he even really “employed” at this point?

A. As KEFI’s COO, Eddy is focussed on managing most of the Company’s employees and in particular the work being done to prepare Tulu Kapi for development. KEFI’s Executive Chairman is focussed on all “external relations”. This split of responsibilities is normal appropriate. Eddy will likely be at at least some of events in London that we have undertaken to host if anyone wishes to meet him.

Q: What if shareholders want more interaction and communication with the Company?

- KEFI considers itself more transparent than most, without breaching regulations or commercial-in-confidence matters. We try to be very communicative, such as with this Q&A.

- We also until recently maintained Quarterly Reports and Webinars, neither of which is a regulatory requirement. We are happy to re-activate those processes if that is preferred by shareholders and will take another poll at the Webinar we will now hold in June to ensure this is a broad-based request.

- One thing we cannot do is to provide exclusive briefings to selected shareholders or subsets of shareholders, in particular unregulated shareholders. We used to have shareholder get-togethers several times a year and that can also be re-instigated if numbers justify but the invitation has to go to all shareholders.

- The Board itself is structured to seek maximum alignment with the business agenda and with shareholders’ wishes, as follows:

- a deliberate balance of the spectrum of key mining and in-country expertise. This can be seen in the individuals’ CV’s as set out in presentations and the Annual Report.

- We have analogous structures at subsidiary boards.

- A majority of independent non-executive directors at the parent company board.

- An overall composition of the parent company board which is reviewed and renewed annually by shareholders, with 2 directors standing always down each year for review and re-election at the discretion of shareholder vote.

Q: Are the consultants' success fees mentioned on Slide 12 of KEFI's May presentation included in the disclosed options/warrants?

A: KEFI has negotiated the right to pay some service providers in stock at market prices post signing. Not an obligation. We will optimise in the final allocations.

Q: The metrics on TK Project Economics slide have changed between February and May KEFI presentations. Why does the May scenario have fewer tonnes at lower grade & throughput?

A: The open pit numbers are unchanged and the preliminary economic assessment of underground was refined. Immaterial impact on the overall value proposition and we will provide detailed updates in the Annual Report to be released soon.

Q. I note in your latest presentation you mention the following:

Final Board Ratification by banks upon Parliamentary ratification of AFC Membership.

As per your RNS dated the 18th March, you said , “the Company has now been advised that both banks have also processed Board approvals for the Tulu Kapi project”.

Once conditions have been satisfied it is my understanding that no further approvals or ratification are required as per their process:

When the Africa Finance Corporation (AFC) grants a conditional board approval for a project or financing arrangement, this approval is typically contingent upon the fulfillment of specified conditions. Once these conditions are satisfactorily met, final board approval is generally not required. Instead, the process advances to the next stages, such as legal documentation and fund disbursement.

Understanding Conditional Board Approval

A conditional board approval indicates that the AFC Board has agreed in principle to support a project, subject to certain prerequisites. These conditions may include:

- Completion of detailed due diligence

- Finalization of legal agreements

- Securing co-financing or guarantees

- Obtaining regulatory or governmental approvals(Green Climate Fund)

Once these conditions are fulfilled, the project can proceed without necessitating a second round of board approval.

Post-Approval Process

After meeting the stipulated conditions, AFC typically moves forward with:

- Drafting and signing legal agreements

- Disbursing funds according to the agreed schedule

- Monitoring project implementation and compliance

This streamlined approach allows AFC to efficiently manage project timelines while ensuring that all critical requirements are addressed.

For specific details regarding a particular project's approval status or conditions, it's advisable to consult directly with AFC or refer to official project documentation.

Thus, I am confused as to why it needs final board ratification. Can you please clarify.

A: Your analysis is correct, as regards AFC. AFC Board has indeed approved. TDB has also approved but needs to ratify the expanded facility.

A: As regards the works on the Mining Licence area: the Owner’s team designs the mine, process flow-sheet and on-site infrastructure. It takes specialist advice as and where required.

The plant and site infrastructure flow-sheet is then optimised, detail-engineered and its building overseen by Lycopodium. Lyco is a process engineering contractor.

The earthmoving for infrastructure is by the civil contractors under Lycopodium and for the mine is under the mining services contractor, BCM. BCM is a civils and mining contractor.

Both Lycopodium and BCM report into TKGM Project Management , all monitored overseen by KEFI management. KEFI Non-Executive Directors also sit on operating company Boards, as do partners’ representatives. KEFI controls overall and warrants to protect the contractors, partners and financiers.

Q: What happened to the previous mining contractor?

A: They were replaced for the reasons given in the RNS.

Q: Did the change of mining contractor impact Lycopodium or other contractors?

A: No

Q: Why did you not flag the possible change of mining contractor?

A: It was commercially confidential and in the Company’s best interests to keep it that way.

Q: Shareholders did not see coming that a new mining contractor would contribute to the TK funding syndicate. Are there more surprises coming?

A: We have always said we would optimise the finance plan and we will keep doing our best to maximise choices and negotiate best outcomes.

Q. The TK funding requirement of $320m is now serviced by reported commitments from the Federal Government ($20m equity in the JV company), the 2 banks ($240m in senior and subordinated debt) and the newly appointed Operator ($23m). That leaves $37m unaccounted for although our money has been relentlessly ploughed into the project and may have discharged that proportion of the budget already. Can you clarify this?

A: As regards your use of the term ”Operator", this conveys a fundamental misusnderstanding which deserves explanation. The Operator is the Owner, TKGM. The Guarantor of the Operator’s performance is KEFI which has undertaken contractually to provide the human and capital resources for TKGM to perform. That is because KEFI is accepted by the contractors and banks to develop TKGM into the organization it needs to become. Partes like Lycopodium and BCM (newly appointed mining contractor) are contractors to TKGM.

As regards your “unaccounted” $37 million, we do not really understand the question. EthioPrefs remain part of the plan and will provide the largest contribution to this portion, supplemented by capex already spent and any last-minute tweaks amongst syndicate members if and as required once final costings are certified.

We maintain the Company’s focus on maximizing non-dilutive capital-raisings wherever reasonable to do so. This is succeeding with the contractor financings, debt capital, the TKGM share capital and the Equity Risk Notes to BCM and planned Ethiopreference Share investors. Accordingly we feel thatwe have removed any concern about whether the finance will close successfully.

Q. Has the process for refreshing the contractors contract already started? If so, is it wise to spend 500k doing this (Harry's quote on the vox interview) before ratification has even been granted. If it isn’t being refreshed now and it takes 2 months to complete (Harry's timeline in the same interview) how are we going to be in such a position to (in Harry's words) "look at each other in June" and start construction when this piece of work will still need to be done?

A: We agree that ratification needs to be clarified and we note that is reportedly imminent. The Lycopodium price-refresh then takes one month to yield results good enough to finalise negotiations. Certification and signing will take a little longer.

Q. It seems with every update that resettlement of the community is being prepared. Yet preparations never seem to be completed?

A. That has not surprised anyone experienced in moving a community of 1000’s of people, besides it being the first project of this nature in Ethiopia. The government has recently completed property surveys for Phase 1 of the resettlement which is the piece on the critical path at commencement of Major Works.

Q. Harry mentioned that physicals such as starting the build of construction camp, drilling of water wells ETC will now be sequenced to start over the next 2 months. Can this be elaborated on?

A. Current activities include a new security camp now being built adjacent to mining licence area, expanded water source installed. These are expansions of facilities as the numbers of people involved is increasing.

Q. The RNS dated 13 November clearly laid out the reasoning for the GMCO Strategic Review and sale of the Saudi assets. This included prioritising its majority owned projects, focusing on a large Ethiopian pipeline and that raising sufficient funds for Saudi is considered too dilutive. How has the potential $23m injection into Tulu Kapi's pre-production costs changed the reasoning of the above?

A: We believe the combination of the Ethiopian Preference Share and the partnership with BCM will negate any pressure to dispose of our stake in GMCO in order to fund Tulu Kapi. And while we remain firmly focused on majority owned projects we also believe that there is tremendous value in the GMCO business.

Q. Why has the remaining TK capex reduced by $20m to $300m?

A. The $300m figure that you refer to is net of contractors’ funding contribution and thus excludes the $20m investment by the Ethiopian Government.

Q. In the update of 7 January 2025, $60m of the required funding comes from up to $30m Ethioprefs and $30m from ‘certain Middle Eastern and other sectoral investors’. Can you please clarify what has happened to the interest of these Middle Eastern and sectoral investors as it appears that their investment is now to be replaced by the Saudi sale proceeds?

A. The following information hopefully provides clarification and background.

The total amount required is being reconfirmed for its last minute-fixed pricing elements. If we assume no change from $320M, $240M is planned from debt-capital and $80M equity-risk capital (including the Government's investment). Given that the debt component has settled down and is now being prepared for closing, we now naturally can optimise and finalise the equity capital from amongst the choices created over the years. We have done this quite deliberately so that KEFI is not over-reliant on one equity source or another.

Accordingly, KEFI still optimises capex contribution by contractors, contribution by Preference Shares issued to local qualified investors, specialist investors in the region focusing on our pipeline in either or both Ethiopia and Saudi Arabia and, of course, other parties with a declared interest in KEFI. We are not in a position to provide a running commentary on the amounts provided by the various equity investors until deals are done. There will be ebb and flow of the planned contribution from each investors and that is unavoidable until we have completed the process.

Further background on KEFI's approach to funding Tulu Kapi is available in this interview:

VOX Markets - Q&A with KEFI's Executive Chairman, Harry Anagnostaras-Adams.

Q: Can you also please comment on why KEFI did not provide reasons or explanations for timeline slippage in the RNS?

A: We assembled the debt offering and documents by the end of March. Before signing, we need to, with counterparties, finalise certifications, optimise equity and satisfy conditions precedent. Those things could not be done without having clarified the debt offering. These processes will take approximately 2-3 months and were explained in KEFI's most recent RNS.

Q. Is triggering Tulu Kapi's development now dependent on selling GMCO?

A. No.

Q. With AFC ratification a critical element to finalise financing, shareholders have been told that all parties are aligned, yet its completion date has continuously been pushed back and missed. Why should investors have confidence that Kefi can deliver on the most recent dates?

A. KEFI does not run the Ethiopian Parliament. But we have been advised by the highest Government officials that we can rely on that process being completed such that it will not in any way hold up the launch. That is the reality.

Q. The 8 April RNS notes that construction of initial site facilities is underway as well as expanded water supply and camps for construction and security. When will you provide photos of these site construction activities?

A. We are aware that there is some interest in seeing photos of site activities. We do plan to do so but need to judge when it is appropriate to publish photos of site activities based on privacy and security priorities.

Q. Why is there secrecy about the ratification process, I cannot understand why a timetable cannot be published?

A. Ratification is a parliamentary task, and we are advised in good faith that ratification is in process within project requirements. The company is in no position to dictate parliamentary timetables or advise on how long other agreements have taken to ratify. Today's RNS notes that the focus is to complete this quarter Government approvals of residual administrative matters, including AFC membership ratification by the Ethiopian Parliament.

Q. I note that the area surrounding TK and also to the North not only still belong to the Hong Kong shell company, but have recently been extended for another year. Can you please comment on what the company is doing in respect of this, and whether you still expect them to be “returned”?

A: We remain confident that the successful launch of Tulu Kapi will sort this issue and our administrative processes remain focused thereon. It is not in shareholders’ interests to elaborate publicly.

A. The Hancock RNS was released once the Saudi Government decided we had won the tender. And even it had been an application rather than a tender, we would need to await the granting of the licence.

Q: Why is it that Ethiopia appointed KEFI’s Chairman as consul to Cyprus?

A: The Ethiopian Ambassador to Cyprus also looks after 11 other countries and she wanted support on certain specific economic initiatives in Cyprus, such as targeting Cyprus Pharmaceutical companies to manufacture in Ethiopia for import replacement – just as important as export generation.

Pharmaceuticals is the largest export sector from Cyprus, exporting to over 120 countries from about 20 factories under a number of companies. The Chairman has successfully carried out those honorary duties during his brief stopovers in Cyprus.

Q: I read in the media that a civil war in Tigray has started again. Please comment.

A: The past “civil war” was a 5% ethnic minority attempting a coup and being squashed by the 95%. The Tigray Region is on Ethiopia's border with Eritrea and about 1,300km from Tulu Kapi.

In Tigray last week, one Tigrayan seized power from another and then headed to the federal capital to talk it through. That is what we saw on the ground.

Q: If the community wants the project to have gone ahead already, why have you not moved them already?

A: It would have been illegal without simultaneously triggering the Project and its programs for all those people.

Q. When will you hold your next webinar?

A. We have elevated our disclosure plans (and shareholders expectations’ in respect thereof) way beyond regulatory requirements. Anything other than an RNS is not required from a regulatory viewpoint and anything “extra” like a webinar or a website Q&A is sometimes impossible because the Company is “pregnant with about-to-be-disclosed material information”.

And, of course, if the company informed shareholders that it is pregnant with undisclosed material information, that of itself is an unclear disclosure which is unfair and unhelpful to shareholders. It sometimes takes weeks for multiple significant counterparties to approve a KEFI RNS.

So…frankly it has been a frustrating struggle recently to slot in a webinar due to the large number of milestones to report in recent months in particular. We like being transparent with the Q&A and with Webinars but that enthusiasm must be tempered by regulatory rules and guidelines.

We’ll time the next Webinar after taking advice from the NOMAD in particular. It may be necessary to change its format and, for instance, invite one of the independent research analysts to present their refreshed deep-dive report (after meeting senior in-country management) and filter questions on sensitive areas.

Be that as it may… the main thing is to make progress and report formally as soon as possible.

Q. AFC ratification has been designated as ‘fast tracked’, Kefi stated: 'Ethiopian parliamentary ratification of AFC membership, currently targeted for February 2025’. Can Kefi update shareholders on the status and expectation along with any issue that is holding this up?

A. See KEFI RNS 11 March, in which awaiting the AFC top-level visitation at end-February was referred to. KEFI is familiar and comfortable with the Government’s internal process.

Q. When will the Ethiobonds be listed? Kefi stated on Feb 4th "Preparations are advancing for the local listing of these bonds."

A. The Private Placing will be with project finance settlement requirements and the listing will follow whenever it suits. The Ethiopian Securities Exchange has only just started.

Q. Kefi said it had a deadline of 28th Feb for proposals/offers for its Saudi assets and its 15% holding in GMCO. This date has of course passed and as a shareholder I would have expected an announcement saying a number of offers have been received and are being appraised and we anticipate updating by x date. But complete silence makes me wonder if there hasn't been interest of significance. I hope I am wrong but that’s the understandable conclusion.

A. We said we are targeting the GMCO sale to be resolved in tandem with the launch of Tulu Kapi. We are engaging with the long list of parties interested in KEFI’s 15% shareholding on GMCO. We are allowing time for all to digest all the recent Saudi developments announced during February, and we are indeed short-listing parties.

Q. Kefi stated in a presentation that "the remaining US$30 million is being finalised with certain Middle Eastern and other sectoral investors.” Is this still the case or is the required $30m linked to the money that may come in from the sale of the Saudi assets? Why no clarity or update. Will it be done via the sale of Saudi assets or at a subsidiary level reducing Kefi’s holding in Tulu Kapi to say 70%. I think I would prefer the latter depending on how much is brought in by the sale of Saudi assets.

A. See KEFI RNS 11 March.

A: It might be one of many reasons and is managed by an officer duly experienced in compliance and acceptable investor relations for listed entities, including:

- Anything material must be via RNS; and

- The company website is not a publicity tool for unaccountable parties.

Q: Have any KEFI directors sold any shares?

A: Director sales would be publicly reported and none of the existing directors have done so.

Q: As KEFI moves from explorer to developer to producer, will there be board and management changes?

A: New directors have regularly been appointed at both the parent and subsidiary boards.

Likewise the executive teams of operating companies TKGM and GMCO have been refreshed several times including significant changes in the past year as the required specialities changed with priorities.

Q: A recurring question is why the Chairman resigned from Atalaya Mining just before recommencing production at the Rio Tinto Mine in Spain. It is a riddle to many and begs questions about his intentions at KEFI.

A: The Chairman commented as follows: “At Atalaya, having dealt with the issues which prevented that project’s development for decades, it was timely for us to introduce Spanish leadership at the top for government permitting and social licence - to get the show on the road. Subsequent events validated that decision. We continued to support Atalaya behind the scenes in sending some people to jail.

Each country is different and requires its own forms of alliancing and management. For instance, in Saudi Arabia the major shareholder is Saudi. In Ethiopia, the Government is KEFI’s partner and our local and expatriate leadership team play important roles in the industry associations and other industry support frameworks locally and internationally.

Q: Certain pundits suggest KEFI’s calculations of NPV are questionable. Please explain the basis of calculations.

A: Some contextual comments:

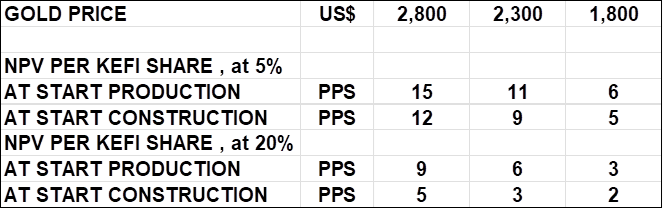

- We regularly report a range of NPV’s eg “for Lenders” as compared with “for Investors” and also for difference gold prices, ranging from “Lenders' Assumed Price” to “Spot Price”.

- Our latest Presentation is on the website and provides such a range. We provide our opinion and enough information for investors to select their preferred basis of estimate.

- Our gold equity analyst advice is that listed developers’ “potential valuation on the stock market at the start of production” is the +/- the NPV (at 5% discount rate) at that point in time and that, in the interim, the market at any point in time reflects its risk discount against that NPV – pending the company demonstrating its risk-reduction as it moves through stages from pre-permitting through to production.

- For such inter-company benchmarking of potential value/market capitalisation at the start of production, we are advised to discount at 5%. As a comparison we tabulate below against different gold prices and also a 20% discount rate.

Q. Why one year later after stating AFC country membership has been granted, is country membership for AFC still going through the approval/ratification process? Not a worry as it is being fast tracked through Parliament but still a puzzle based on the above suggestion they already had membership on 3rd Jan 2024.

A: Ministry has approved. Parliamentary ratification awaited AFC credit approval, issued December 2024.

Q. Taking guidance from the Q&A reply on 24th May 2022 is it still a 24 month timeframe from mine construction to being fully operational or have you managed to shorten the timeframe? If it hasn’t been shortened, how will you, as suggested in presentations, get commissioning in second half of 2026 and a full year of operation in 2027? Can other works proceed whilst the Community is being moved? Will it take up to a year to move the community?

A: Community resettlement starts at the beginning of Major Works. Commissioning starts before the end of Major Works which are designed to deliver full production.

Q. What is the exact timetable for the resettlement of the local population at Tulu Kapi?

A: A small area is resettled prior to Major Works. The rest are sequenced as appropriate within the Major Works.

Q. Does Kefi anticipate receiving an extension to the 2035 license expiry date as potential further discoveries are made extending the life cycle of the mine beyond this expiry date?

A: The Mining Licence contains the right to two 10-year extensions.

Q. Harry mentioned in his interview with Proactive Investors that developing a series of projects in Ethiopia to follow on from Tulu Kapi is planned as it’s what fund managers who he has presented to want to see. Can he confirm that this will be funded at subsidiary/project level or via farm outs and the anticipated 80% holding in TKGM will not be reduced significantly?

A: KEFI will maintain its stated focus on regional/subsidiary level funding.

Q. Most current investors would like to hear that no further placings will be done before before funds flow from Tulu Kapi in 2027. Can Harry confirm that in the event Saudi assets are sold for the valuation or more in the presentation ($80 an ounce) that, indeed, the Company does not anticipate any further placings before Tulu Kapi is operational with the proviso that it may keep that option open of the share price starts to reflect the NPV to a greater extent?

A: That is the intention.

Q. Kefi stated in the recent presentation: “up to US$30 million in the form of gold-linked preference shares of KEFI Minerals (Ethiopia) Limited expected to be issued as the Ethiopian Stock Exchange is launched (currently scheduled to be by the end of January)”. The Ethiopian Stock Exchange has launched - does this statement and timescale still apply?

A: All this advancing as foreshadowed.

Q. In the recent presentation Kefi stated that: “the remaining US$30 million is being finalised with certain Middle Eastern and other sectoral investors, as the Company looks to conclude the optimal financing scenario from interested parties.” If this is finalised as envisaged in the statement above will this result in a reduction of the % holding of Kefi in TKGM to say circa 70%? With the Govt. investing $20m for 10% and up to $30m for 10% being raised from gold-linked preference shares of KEFI Minerals (Ethiopia) Limited will this create a benchmark for the % that will be relinquished for “the remaining US$30 million being finalised with certain Middle Eastern and other sectoral investors"?

A: Yes, now that banking has settled down adequately, we will run-to-ground several parallel streams of work to optimise the outcome for KEFI. Please note that it is proposed that the gold-linked preference shares have no rights of conversion into voting stock.

Q: I read that Premier Miton is winding up its microcap fund. Also see that they were a recent KEFI investor. Does this have a serious impact on KEFI?

A. No impact. If Miton did sell, its holding is less than a day's average turnover in KEFI shares.

The wind-up of the small-cap fund specifically reflects the general malaise of UK small stocks - KEFI is one of the survivors where many have fallen.

Q: KEFI shares turnover more than 100% per annum. You seem to deliberately attract share traders rather than long term institutional investors.

A: The 100% turnover is healthy. Institutional investors will get involved as the company’s business grows and matures.

We have in the meantime built a syndicate of large institutional financiers at the subsidiary level.

Q. Please provide detail on executive salaries.

A: We provide the following details in respect of the Executive Directors, whose remuneration is disclosed annually in statutory accounts.

The Executive Chairman (EC)and Finance Director (FD) were founding directors in 2006, when KEFI was spun out of Atalaya Mining (then EMED) to separately focus on exploration in frontier markets.

All their remuneration is detailed in the statutory accounts. Other personnel remuneration is subject to privacy.

The EC and FD received nil remuneration from 2006 until 2013 and since then received an aggregate of £250K in cash per annum and £270K in shares pa at prevailing market prices.

Approximately 75% of their aggregate remuneration was recharged to the operating joint ventures to compensate KEFI for services provided to partners.

All pay rates are based on independent industry surveys. Policy, implementation and review are in accordance with the details set out in the statutory accounts.

The pay rates and systems are also independently reviewed on behalf of the partners and financiers providing development capital.

Q: Exactly what has been achieved and ticked off with early works and what is left to do to enable major works?

A: An updated Presentation on the website sets out that we now move into certification and documentation finalisation for launch of Major Works.

Q: Harry said in the newspaper article that community resettlement needs to be properly and smoothly achieved before moving onto Major Works, yet the AGM statement says that resettlement is part of Major Works, can this please be clarified?

A: Resettlement needs to be properly and smoothly agreed formally, before being triggered as part of Major Works.

Q: Is Resettlement part of Major Works or do we have to wait for it to happen before we start Major Works?

A: We always highlight that the resettlement budget and schedule needs formal agreement before being triggered as part of Major Works. Perhaps you have been confused by the fact that a small resettlement package has just been committed before Major Works as a means of locking down the big numbers.

Q: Can we expect a imminent sale of our Saudi assets or is it fair to presume this is early days and such a transaction will need a lot more time?

A: We target that it be resolved in tandem with the launch of Tulu Kapi.

KEFI's Executive Chairman Harry Anagnostaras-Adams was asked a number of questions by Ethiopia's Capital Newspaper.

This recent interview is available via this link Tulu Kapi’s Impact on Ethiopia’s Mining Future or can be found on pages 14 and 15 of this PDF of the Capital Newspaper which also contains articles on Ethiopia's recent banking reforms.

Q: The Ethiopian Government recently passed legislation to allow foreign banks to operate in Ethiopia by establishing subsidiaries, opening branches or representative offices, or acquiring shares in existing local banks. Does this legislation have any relevance to the Tulu Kapi financing?

A: Opening up the domestic banking sector is great but separate from and in addition to country membership of the development finance institutions like the banks lending to Tulu Kapi.

Q: Why not offer ARTAR a piece of TKGM in exchange for more of GMCO?

A: We have a good longstanding relationship with ARTAR and several ideas are on the table in our strategic review.

Q: On reflection, how do you see 2024 in terms of KEFI progress?

A: The slowness of banking frustrated everyone. On the other hand, to bring banking to a head for larger amounts will come to be seen as an achievement for the first ever such transaction in Ethiopia.

Likewise, the slowness of security settling down at site and transport routes frustrated everyone. On the other hand, to bring it into line will come to be seen as an accomplishment in a country that had a civil war 3 years ago.

Similar contrasting comments can be made across many aspects. The frustration to all has been palpable, as is the excitement and anticipation within the team on the ground. That it has taken longer is obvious to everyone. That it is a stronger and higher-value project now, is obvious to those inside the projects.

Q: Why put various staff on webinars if they cannot be relied on to give reliable timelines?

A: Webinars are not meant to provide information extra to that published in RNS. We will conduct a poll at the next webinar as to whether shareholders want us to continue with webinars. Last time we did such ga poll it was requested to continue. We will proceed as requested by shareholders.

Q: What is the differences between Early Works and Major Works that are often mentioned?

A: Detail has been set out in the Annual Report and other announcements. Essentially Early Works are for the government to prepare security and community and the company to support government, finalise the finance and the contracting syndicate to launch Major Works.

Major Works is resettling the community, procuring equipment, training workforce, constructing the process infrastructure and open cut mine, and the large operational readiness program.

Q: When will the construction financing fund could be withdrawn?

A:The timetable is to finalise this month the detailed final terms and conditions for $240m debt and the lead investments of equity capital.

Jan-Feb: Independent certifications of readiness to trigger Major Works for signing definitive detailed documents and drawdowns to follow as disbursement takes place per schedule.

Q: How is the progress of resettlement in Tulu Kapi?

A: By law, the government prepares the community and resettles them. We support that process and enlarge it to comply with international standards. It is on track for resettlement to be triggered as part of Major Works.

Q: Does Kefi has other gold exploration projects in Ethiopia?

A: Several under application or negotiation.

Q: Where is the Q3 operational update? And accompanying webinar?

A: An update will issue in early January and webinar will follow. We can take a poll at the next webinar as to whether shareholders want Quarterly Updates, as we have been lobbied to stop the quarterlies as we release news on a continuous basis, as and when events happen.

Q: Why issue shares at a discount to market?

A: The price was set on Friday 29 November at a small discount on VWAP for previous 5, 10 and 20 days. This is a normal process. Placing executed along with retail offering on Monday 2 December.

Q. What dates are now being worked for financial close? This year? Q1 2025?

A. The transition from Early Works to Major Works will take place as community and security readiness is independently confirmed. Financial closing and government clearances are planned to be sequenced within this process during early 2025.

Q: Who are Safaya? A new investor in KEFI?

A: Yes. Safaya is an investment vehicle of a number of Middle East family offices.

Q. Please provide a breakdown of the costs for the remuneration package proposed to be issued as stock (decision at the GM in the new year). Are you part of this? …and Are you prepared to push/cut back any or your director remuneration until after the banks have signed off the financing?

A. Remuneration packages are, in accord with industry standards, made up of Base Salary and Short Term and Long-Term Incentive payments on the achievement of certain milestones. The signing off of the bank funding is one such milestone as set in the remuneration report of our annual report.

Q. Why is the GM being held in Australia? Is it just to ensure that no shareholders turn up?

Q. Is it not dangerous selling Saudi interests and putting all our eggs in one basket, especially as we have not yet managed to get Tulu Kapi through the full financing process with the Ethiopian Government? KEFI has previously stated having more than one project is a strength.

A. Generally speaking, having more than one project remains a strength, but it became a capital allocation issue, and it was decided to focus our attention and resources on Tulu Kapi which is, by far, our most advanced project and in which we have the most significant interest.

Q. When do you envisage consolidating the shares in issue, as surely a mid cap miner will not be taken seriously with over 8 billion shares (so far) in issue?

A: Share consolidation has not been considered at this time but will be as and when necessary.

Q. In November 2023 Eddie stated at a presentation that the banks had indicated they required another 2 to 3 weeks to finalise the finance, what has happened since to delay? It has obviously cost the company dearly with more than 4 billion share dilution since.

A . Eddie would have been referring to lenders ‘credit approval’ which is different than finalising the finance, by which I think you mean getting the funds. There is still a process that needs to be done ahead of getting access to funds but in the meantime, we have to continue with work on the ground which of course requires funds – hence the equity issue.

Q. If we are as close to financing as the company claims should we not at least have a chart available on the website that shows everything that is required being ticked off when completed (we seem to always have one more thing added that was unknown) and maybe a few pictures of things that are going on on Facebook or twitter. The company needs to up its communications we are to see an improvement in shareholder sentiment that is currently very low after the latest delay and discounted share issue.

A. Our communications are quite frequent and extensive especially for a small company. I think what you really mean is that we need to show progress on the ground and report that, which we will do in due course.

Q Why do certain journalists/tipsters seem to get information for their private use when surely it should be in the public domain?

A. This is simply not the case. Information released by KEFI is always done in accord with regulatory norms and procedures.

Q. At the last webinar I asked a question on the day, "As you've just stated, if the timing of the financial close with the banks slips does Kefi have sufficient funds to see us through to financial close without a raise." The response was yes. The truth No, as we've just seen another dilutive raise.

A. We always give the best estimate we can of the timing of an event. However, there are many variables in a project like this and the potential for timetable slippage is significant.

A: The report is wrong and we will publish the following statement:

KEFI Gold and Copper Responds to Misleading Reporting by The Reporter

KEFI Gold and Copper, along with its Ethiopian subsidiaries KEFI Minerals Ethiopia and Tulu Kapi Gold Mines, operates under the highest standards of transparency and regulatory compliance.

We have noted false and misleading information published in The Reporter. We respectfully demand that The Reporter adheres to the same standards of accuracy and accountability expected of responsible journalism.

Specifically, we wish to clarify that the recent capital raise of approximately £10 million from our international shareholders was fully disclosed and detailed in KEFI Gold and Copper’s official regulatory news statements. Contrary to the claims in The Reporter, no member of our group has received any warning letters or notifications from any Government agency on any matter.

KEFI Gold and Copper and its subsidiaries are proud of the constructive relationships we maintain with all members of the community and all levels of the Ethiopian Government. We are at a loss to understand either the basis or the motivation for the claims made in The Reporter’sarticle. We urge The Reporter to issue a correction and ensure accurate reporting in the future.

A: Unlike many other companies, KEFI writes off all expenditure in its accounts until the application for a Mining Licence which reflects a decision being made reflecting a development commitment . There is no “right” or “wrong” - this is just our policy which we believe conservative for statutory reporting.

Therefore at KEFI, book value in the statutory accounts is always less than historical expenditure which usually involves extensive exploration, feasibility study, permitting, financing and other costs.

And, asset market value would be expected to vastly exceed both the historical cost and the reported book value in the statutory accounts - if exploration is successful and/or development studies are positive.

On the other hand, as we all know, stock market values in each different jurisdiction varies on a daily basis from any of these numbers due to any number of factors.

In that context, we provide the following statistics with respect to each of GMCO and TKGM.

GMCO:

Cost was c. $12 million since 2008, accounting book value nil, indicated market value $50-80 million based on the opinions of research analysts who have issued reports.

TKGM:

Cost was c. $50 million since 2014, book value $35 million, indicated market value $495-835 million based on the opinions of the research analysts who have just issued reports.

Q: The recent Interim Results included a statement that "the co-lender's credit approval which now includes a discussion in respect increasing the financing amounts on offer".

Is this statement alluding to the co-lender who has already signed off and, if so, would it be fair to surmise that this is a hedge against the other co-lender who hasn't as yet signed off failing to do so?

And, why are additional funds being sought ?

A: It is applicable to both co-lenders and the reason is to reduce the need for equity capital by raising the debt-gearing level in line with the improved gold price.

Q: I noticed that Kefi may have secured a £2 million Bridging Loan, is this so current investors are not diluted at current levels?

A. Yes, as done many times.

Q: In the Interims it stated Q4 2024 for sign off on Tulu Kapi, but are we still on track for October?

A. Yes, for the bits due in October.

Q: There has been mention of 30 million Gap/Shortfall, is this because the 2nd Bank has suggested they are not going ahead or investors at a subsidiary level are suggesting or not come forward in the suggested time line posted in the Media/RNS.

A. No idea what you are referring to.

Q: Please explain who the people are in the community meeting photo that KEFI recently posted on X. Where are they, who hosted them, the agenda and further details?

A: Our community liaison team comprises 25 people and our Country Director is Abera Mamo. They meet with community and local government agencies regularly. As a policy, we refrain from giving details of meeting attendees without their explicit permission and we generally consider it unnecessary risk to their privacy to do so.

Q: Have both banks confirmed that no more site visits are required for their credit committee approvals?

A: Yes. They sent their inspectors and are happy for the purpose of credit approval, already granted by one of them.

Q: Please explain why the compensation calculations in respect of the temporary construction camp set a useful precedent?

A: Simply that it is a small read and the relatively small area allows the precedents to be set for amounts payable per eligible item. This assists greatly in confirming our overall budget.

Q: Has KEFI caught up with its GMCO contributions or is there a risk of dilution by ARTAR?

A: No. there remains the risk of dilution.

Q: In his presentation at the Gold Forum Americas, Harry referred to his working for the oldest mining family office. Who is that? And what type of mines did they build and invest in?

A: During Harry’s time in Australia he worked for some 20 years with the family office of the Darling family which co-founded BHP. Harry led or supported the leadership teams that developed or restructured mines in gold, alumina, zircon, magnesite, coal, natural gas and they also built what was then Australia’s premier gold-focused investment management business backing the selected gold companies. All mines and investments were successful except for the coal mine which was closed to prevent risk to personnel due to a spontaneous combustion underground fire.

Q: In his Gold Forum presentation, the moderator was cut from saying that KEFI had “the second”. The second what?

A: The highest number of meetings requested by investors at the Gold Forum.

Q: Given that Harry founded Atalaya Mining, why did he leave before production started?

A: Spanish management was best for the next stage at Atalaya and, over at KEFI, development and financing management was best for its next stage.

A: There are no negatives. And it is consistent with foreshadowed policy reform which goes hand-in-hand with the huge IMF funding package to support Ethiopia’s economic recovery after the self-inflicted damage of the last five years. The democratic and economic reforms provide an excellent backdrop for our project.

This is also a very positive backdrop for our two development banks whose roles are now clearly up front and centre as part of a big push by western development financing institutions.

The regional investor interest in our project has just been reinforced because of its natural protection against devaluation and inflation, by generating exports in USD.

Responses to questions not answered during KEFI's webinar held on 22 July 2024 are now available on the Investor Meet Company website (investormeetcompany.com - registration required) under the Q&A tab for that investor presentation and also in this document.

Q1: What is overall timetable to production?

A: Early Works plus Major Works are designed to result in production operations starting mid-2026.

Q2: What is the bank by bank progress with the project financing? And how does drawdown happen?