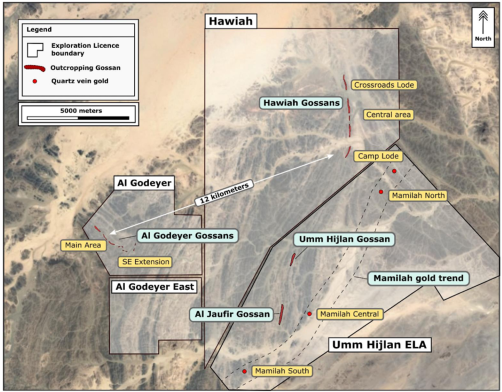

Hawiah EL

Hawiah is located within the Wadi Bidah Mineral District (“WBMD”) in the southwest of the Arabian Shield.

GMCO commenced drilling at Hawiah in September 2019 and quickly confirmed that a large-scale Volcanic Massive Sulphide ("VMS") style of deposit was below the outcropping 4.5km long gossanous ridge. KEFI released the key outcomes of the initial Preliminary Economic Assessment (“PEA”) for the Hawiah Project in September 2020.

VMS deposits are well understood to form in clusters, and Hawiah is no exception. Exploration commenced at the nearby Al Godeyer Project in early 2022 and drilling quickly confirmed similar copper-gold mineralisation to the Hawiah VMS deposit.

The recently granted Umm Hijlan EL adjoins the original Hawiah EL consolidates a 210km2 strategic licence area for GMCO and offers the prospect of adding significant additional oxide and sulphide resources. The Umm Hijlan EL has already been demonstrated to contain the southern strike continuation of the main Hawiah VMS system. The strike length of known gossans on the Umm Hijlan EL is similar to the length of gossans on the Hawiah EL.

- Hawiah MRE of 36.2Mt at 0.82% copper, 0.85% zinc, 0.64g/t gold and 10.0g/t silver; and

- Al Godeyer MRE of 2.0Mt at 0.93% copper, 0.53% zinc, 1.21g/t gold and 7.4g/t silver.

Geology

The Hawiah EL covers a predominantly bimodal mafic and felsic volcaniclastic succession in a broad anticline, with an unusually large expression of surface mineralisation outcropping on the eastern limb. Hawiah’s silicified and gossanous horizon was mapped and trenched by France’s Bureau De Recherches Geologiques et Minieres (“BRGM”) in the 1980s, which identified its gold-bearing potential.

The geological setting of Hawiah appears analogous to other large VMS deposits in the Arabian-Nubian Shield that have well-preserved, mature oxidised zones enriched in gold at surface.

Successful Hawiah Drilling Programmes

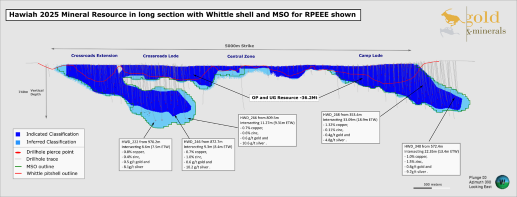

The Hawiah orebody comprises a continuous subvertical tabular layer for approximately 4.5km along north to south strike at outcrop. Localised minor pinch outs occur, which are not significant. Two major zones (lodes) of down-dip extent have been defined (the Camp Lode in the south and the Crossroads Lode in the north) which plunge approximately 25° to the south for 1.7km (Camp) and 1.8km (Crossroads) to approximately 740m vertical depth below surface.

The mineralised layer normally has a thickness of between 1m and 15m and thins towards the edges of the lodes. The central portions of the deposit between the main lodes extends vertically to between 100m and 200m.

Long section showing extent of VMS mineralisation and resource classification in the 2025 block model

Drillhole spacing in the Oxide and Transition domains is typically 50m. Spacing within the Fresh domain is typically 30-80m (Indicated classification) and approximately 120m (Inferred classification).

Hawiah Mineral Resource Estimate

In February 2025, KEFI announced an updated Hawiah Mineral Resource Estimate (“MRE”) totalling 36.2Mt at 0.82% copper, 0.85% zinc, 0.64g/t gold and 10.0g/t silver. The data from a total of 375 diamond drillholes, 114 reverse circulation drillholes and 57 trenches underpin this MRE.

Hawiah Resources reporting to the Open-Pit Scenario have increased to 12.7Mt (up 14% from 11.1Mt) and all in the Indicated Category, reaffirming the potential for an initial open-pit mining operation and a lower start-up capital requirement.

Further information on the 2025 Hawiah MRE is detailed in KEFI’s announcement “Substantial Increases to Mineral Resource Estimates at Hawiah Project” dated 18 February 2025.

Hawiah Preliminary Economic Assessment

KEFI released the key outcomes of the initial Preliminary Economic Assessment (“PEA”) for the Hawiah Project in September 2020. The positive PEA included the following outcomes:

- confirms Hawiah is a high priority Project, with a significant maiden resource after only seven months of initial drilling;

- the maiden resource alone potentially supports a production rate of 2Mt p.a. for seven years for net operating cash flow of c.US$70 million p.a. at current metal prices. After initial and sustaining capital expenditure of c.US$222 million and c.US$46 million respectively, this would indicate an estimated net cash surplus of over US$200 million before financing costs and tax; and

- clear potential for expansion of resources with further drilling below the currently drilled depth of 350 metres of this structurally consistent tabular structure. A doubling of the resource with material of similar characteristics as the maiden resource would indicate an estimated net cash surplus of over US$500 million before financing costs and tax.

Planned drilling of the recently granted Umm Hijlan EL is targeted to quickly define further nearby resources along strike of the Hawiah deposit.

Hawiah is located at northern end of the Wadi Bidah Mineral Belt (‘WBMB’), a 120km-long, north-south trending belt which hosts numerous prospects of three main types:

- VMS deposits;

- volcano-sedimentary deposits associated with disseminated to sub-massive sulphides; and

- shear zone & quartz vein hosted deposits.

VMS deposits are often major copper-lead-zinc-gold-silver orebodies and examples of large VMS deposits in the ANS include:

- Eritrea - Bisha (Nevsun/Zijin) and Asmara (Sichuan Road & Bridge Mining Investment Development) deposits;

- Sudan - Hassaii (Ariab) deposits; and

- Saudi Arabia - Jabal Sayid (Barrick and Ma’aden) and Al Masane (Al Kobra Mining) deposits.